Report by the Joint committee of the House of Lords and the House of Commons on public sewers (contributions by frontagers) : together with the proceedings of the committee and minutes of evidence and speeches delivered by counsel.

- Great Britain. Parliament. Joint Committee on Public Sewers

- Date:

- 1936

Licence: Public Domain Mark

Credit: Report by the Joint committee of the House of Lords and the House of Commons on public sewers (contributions by frontagers) : together with the proceedings of the committee and minutes of evidence and speeches delivered by counsel. Source: Wellcome Collection.

87/126 (page 59)

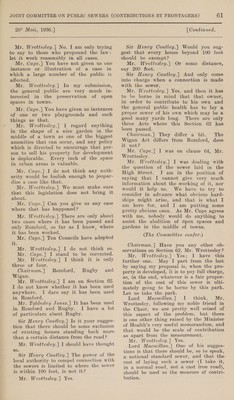

![Lord Macmillan.] This occurs to me, that another standard (you may say it is quite absurd) is rateable value. I do not know whether that is a_ possible solution, because in getting at the rate- able value of a house such as you are describing, as you probably painfully know yourself, under Schedule B you are allowed the value of your residence plus, f think it is, about one acre, which goes in under Schedule B with the house. All the rest of your property is assessed under Schedule B as land in occupa- tion—the income tax test. Mr. Wrottesley.| Yes. Lord Macmillan.|] There is a discrim- ination already being made for another purpose, but a cognate purpose—the matter of taxation. Mr. Wrottesley.| We should not resist rateable value. I am only trying to arrive at something fair for a mansion beside a row of houses, or a cottage be- side a row of houses. Lord Macmillan.| The advantage of rateable value is that you are allowed in the case of rateable value a small amount of curtilage. You are allowed one acre, [ think, for a pleasure ground. Sir Henry Cautley.] Under the Income Tax Acts. Lord Macmillan.] Under the Income Tax* Acts. The balance goes into Schedule B, as land enjoyed under Schedule B, and it is put in a different category. Sir Henry Cautley.] That is nothing to do with rateable value. Mr. Wrottesley.|] No. I know what his Lordship has in mind. I have in point of fact the draft of the Income Tax Bill, and I will read it; it is de- finime “‘bildine’””:. * * buildimg ” - in- cludes the site thereof and all courts, yards and offices attached thereto, and in the case of a dwelling-house, includes also any gardens or pleasure grounds occupied therewith to the extent of one acre.’’ Lord Macmillan.| There you get the definition. Mr. Tyldesley existing law? Mr. Wrottesley.| It is also the exist- ing law. It is lifted clean out of the Act, I think. Chairman.| If you take a place near a town centre, the rateable value is high, and half a mile away it is a great deal lower. Jones.| Is that the Sir Henry Cautley.] I think rateable value might be an unfair test, because in some cases the larger the house the less the rateable value. Mr. Wrottesley. |] It is so sometimes. Sir Henry Cautley.| The house might be so big that nobody would take it, and the rateable value then is almost nil. Lord Macmillan.| How are you _ to That is the real test. Mr. Wrottesley.]| That might be the answer with regard to existing premises, that until development does take place, charge them only for the benefit. What is the benefit of a man with a cesspool? It may be only the fact that he has not to empty his cesspool. I am not now dealing with final improvement in value, Chairman.| The question of a develop- ing building estate is not so difficult. Where you drive a road through a bit of open country, and you strike various houses in that area, how are you going to deal with that? Is not that really the point? Mr. Wrottesley,| That is on the next clause, I think. This is simply running a sewer along an existing road, in order to reach some estate beyond. Chairman. | It comes to the same thing: you build your road, and then you run your sewer. Mr. Wrottesley.| The local authority finds development going on in the peri- meter of the borough, and wants to run a sewer out there, but in the meantime it wants to get something out of me, who live beside the road. I say I do not mind if you find some way of making me pay properly, but to hit me on front- age in certain types of property is ridiculous. Sir Henry Cautley.] Is not it a pos-, sible view that you should not charge the existing house, but rate it on the assessed charge on the frontage, and let it come into charge as it is developed? Mr. Wrottesley.| That is the solution, I am inclined to think. I! have only tried to advance and meet my friend and say that I will do something when I connect. From the point of view of the good of the country, I suggest that the desirable thing is certainly to put off any substantial charge on this type of property, or perhaps all charge, until the property is developed. That is when the property is géing, so to speak, really to derive a benefit from this sewer— every acre of it.](https://iiif.wellcomecollection.org/image/b32186022_0087.jp2/full/800%2C/0/default.jpg)